Article

Floating Wind: Pipeline or Pipedream?

28 July, 2025

By : Andries Veldstra, Senior Underwriter at GCube

At GCube I have regular check-ins with our dedicated Offshore Wind Underwriters team to discuss upcoming projects, industry development, claims trends and yes – to provide an outlook on expected premium vs exposure for our company in the near future.

Amongst other things, we have widely discussed the potential of floating offshore wind over the past few years. It is clear to everyone across the board that we need to explore deeper seabeds, as only 20% of the world coastlines are suitable for fixed bottom foundations – both monopiles and jacket foundations.

Offshore wind is a cornerstone of the global energy transition. Over the past two decades, capacity has soared, with more than 85GW installed. The sector was projected to deliver 264GW annually by 2050, with a total market value nearing £1 trillion. According to these predictions, floating wind could contribute 15% of all offshore wind generation globally.

However, at this point in time unfortunately the sector’s ambitions and reality aren’t aligned.

While there is positive momentum, the sector remains locked in a perpetual experimental state. The largest operational project so far, Equinor’s Hywind Tampen in Norway, has 11 turbines and a total capacity of just 94.6MW (upgraded 8MW turbines to 8.6MW), and although it’s a remarkable feat, the generated electricity of that particular wind farm does not feed into the grid to consumers and households but is used to power a part of the required electricity demand for the oil and gas industry off the coast of Norway.

In recent years a lot of investments have been made into these clean energy projects and there is a significant pipeline of floating wind projects to be developed and deployed over the next few years. However, the sector is still very far from being scalable and profitable.

As Aaron Smith, Chief Commercial Officer of Principal Power, said at a recent conference, “we need adults in the room when it comes to developing floating wind”.

Claims data – or rather lack thereof

At GCube we always base our reports on existing and verifiable claims data, but on this occasion we have a very limited amount of what would be described as typical issues for floating versus fixed, other than delays, very high towing costs for repairs and some welding issues.

Our perception of risk, which determines the cover we can provide and the premium to set would ideally come from accumulated historical data. However, with limited data available insurers have currently no option but to limit the cover and charge relatively higher premium.

Targets vs Reality – a real-life example:

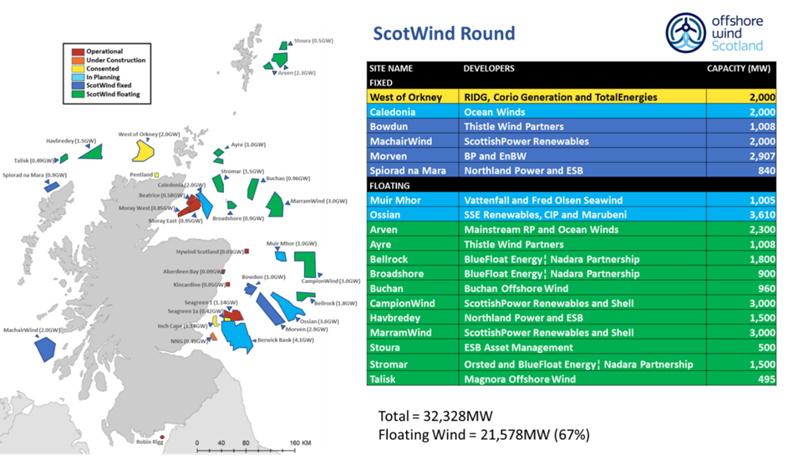

The successful outcome the ScotWind leasing round in 2022 yielded 32.3GW in total, of which 21.5GW were from floating wind.

Picture courtesy of: offshorewindscotland.org.uk

Putting this into perspective, these 21.5GW require 2,150 10MW turbines in a context where the industry is currently struggling to build and install 30MW projects consisting of three of those as semi-commercial projects within a reasonable period of time and make them economically justifiable.

At GCube, we support innovation but also advocate for realism. We are aware that we are by far not the only ones that share these concerns about the viability of floating wind - and many before us have tried to address the key issues - so we have tackled the challenge from an insurer’s perspective.

5 key barriers holding floating wind back

1. High Costs

Floating platforms are expensive to manufacture, transport, and install, significantly increasing the overall project cost compared to fixed-bottom offshore wind. The specialized infrastructure and logistics required for deep-water deployment also add to the expense. In offshore wind, the specifics of working at sea are the main drivers for the extreme costs for installation, maintenance and insurance claims.

2. Supply Chain

In the last couple of years, geopolitical tensions, inflation and the coronavirus pandemic have put severe strains on supply chains globally, and offshore wind has felt these delays too. However, the production of offshore wind turbines, components, cables and steel foundations has been remarkably resilient. These have been developed and scaled up in line with the established targets. So much so, that more fixed offshore wind turbines are being developed faster and more efficiently than ever before.

The downside of this efficiency is that the focus has shifted away from floating wind and investing into research and development of better foundations and turbine technology.

3. Port Infrastructure Constraints

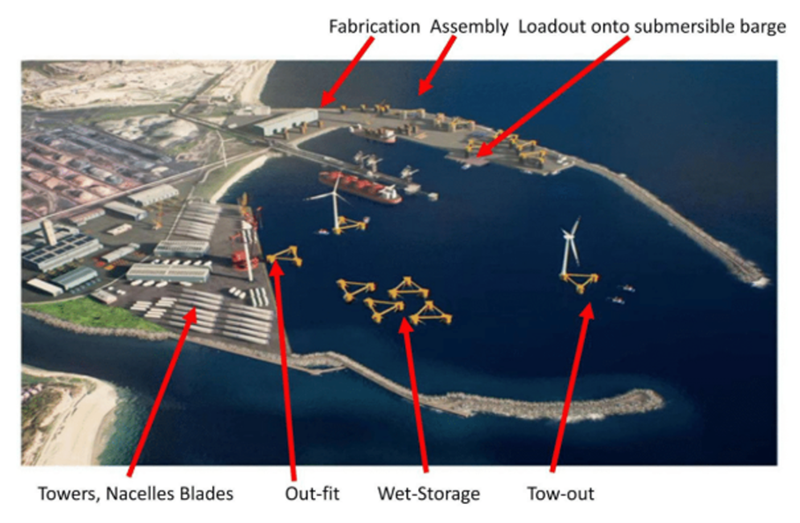

Floating wind demands large, purpose-built port infrastructure. Ports must accommodate deep water and large laydown areas for turbine assembly and the supersized floating platforms.

At present, most ports that would be capable of supporting offshore wind are used for fixed-bottom projects. Floating wind needs a new generation of port capacity—or creative repurposing of existing infrastructure—to keep pace with planned developments.

Not having access to suitable ports massively increases the time needed to repair a turbine, proportionally impacting elements like business interruption or insurance claims.

Typical layout of a floating wind port. Source: ABP, Crowle and Thies (2021).

Fixed foundations in offshore wind port. Source: Tees Business

4. The Challenge of Dynamic Cables

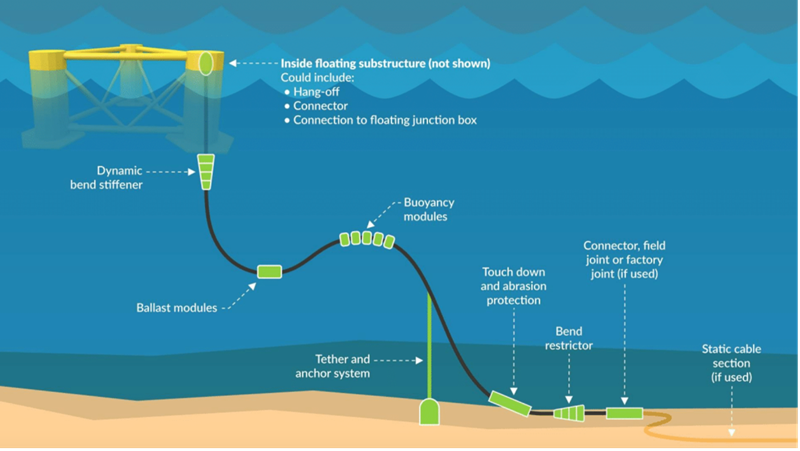

Dynamic cables are essential for floating wind and remain a weak point. Unlike the buried cables – which are still very vulnerable - used in fixed-bottom systems, dynamic cables are suspended in the water column, exposed to constant stress from waves, currents, and external factors like anchor drag by vessels.

Investment in R&D is urgently needed to create more robust, secure, and long-lasting cable systems. It will be extremely important to focus on detachable connections, both on the cable systems and the moorings, in order to meet the initial – however optimistic – goals of being able to maintain and repair back in hopefully available ports.

Floating offshore wind dynamic cable system. Source: A Guide To Offshore Wind

5. Lack of Design Standardisation

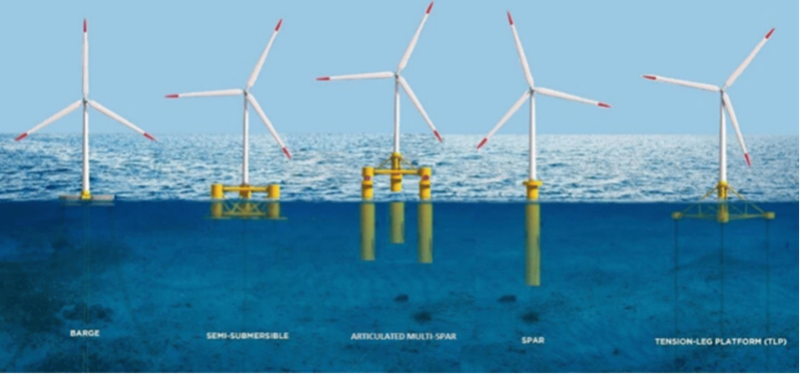

The floating wind industry currently supports a variety of foundation designs—spar buoys, barges, semi-submersibles, tension-leg platforms, and then steel versus concrete. This diversity reflects a sector still finding its way—but it also adds complexity, cost, and risk. Without standardisation, everything from tooling and vessel availability to repair protocols becomes more difficult.

Five types of floating wind turbine foundations. Source: WindEurope

What Needs to Happen Next

To move from demonstration to delivery, the floating wind sector needs a clear roadmap. At GCube, we believe five actions are essential:

1. Standardise Designs and limit Turbine size

Unifying turbine sizes, foundation types, and cable specifications will simplify manufacturing, reduce costs, and make repairs more predictable.

Floating foundations aren’t as adaptable as fixed-bottom ones. Scaling up turbine size often requires a complete redesign of the substructure. Agreeing on a maximum viable size will provide more certainty for developers and insurers alike.

2. Advance Dynamic Cable Technology

Continued R&D investment is essential, along with clear safety standards to build more durable, secure, and flexible dynamic cables.

3. Expand Port Access and Capacity

Ports are critical for assembly, deployment, and ongoing maintenance. Governments and developers should collaborate to repurpose existing facilities and build new ones suited to floating wind’s unique demands.

The Road Ahead: Difficult but Achievable

Being behind on targets doesn’t mean the opportunity is lost. Quite the opposite. But optimism alone won’t make it happen. We need collaboration, investment, and a willingness to make hard choices around standardisation and infrastructure.

At GCube, we remain cautiously optimistic and are looking to support the industry. Floating wind is no illusion. But it must be approached with a level head, a steady hand, and a clear understanding of the risks and rewards ahead.